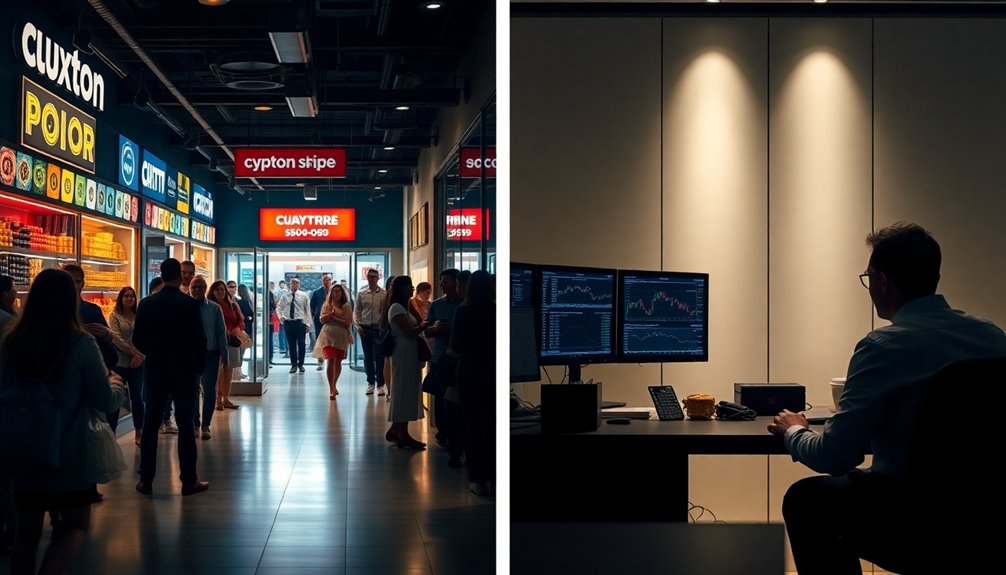

In today's crypto landscape, you'll notice a striking contrast between retail and institutional investors. While pros rely on analytics and maintain a positive outlook, retail players often chase trends on social media, lacking robust strategies. This divide doesn't just influence individual trades; it shapes the entire market. Understanding these dynamics could be key to navigating the unpredictable waves ahead. What does this mean for your investment decisions?

In the ever-evolving crypto market, understanding the differences between retail and institutional investors is crucial for navigating this dynamic landscape. Retail investors typically access online exchanges tailored for individual traders, which offer less liquidity than institutional platforms. You'll usually find retail investors trading in smaller amounts, often influenced by personal research, social media trends, and the overall market sentiment. Their trading tools are basic, relying on what exchanges provide, and their trades generally won't cause significant market shifts.

On the other hand, institutional investors wield considerable market power. They manage substantial investments, often in billions, and their trades can significantly impact cryptocurrency prices and liquidity. With access to exclusive trading platforms and advanced systems like algorithmic trading, they navigate a more rigorous regulatory environment, often supported by dedicated legal teams. This gives them an edge in liquidity, making it easier for them to execute large trades without causing the same volatility that retail trades might.

When it comes to trading strategies, institutional investors excel in risk management. They hedge and manage large positions to mitigate potential losses, while retail investors often lack these sophisticated strategies. Institutional trades can lead to sharper price movements, affecting market stability in ways retail trades simply can't. Furthermore, institutions often diversify their portfolios across various cryptocurrencies, which helps them manage risk better compared to retail investors who may not have the same level of diversification. Institutional investors often utilize advanced trading tools and analytics that are generally unavailable to retail traders, enhancing their ability to make informed decisions. Additionally, institutions often leverage market sentiment to inform their investment strategies, allowing them to anticipate shifts in trends more effectively.

Market sentiment reveals a striking divide between these two types of investors. While institutional players tend to maintain a bullish outlook, retail sentiment often lags behind, sometimes due to their exposure to meme cryptocurrencies. This disconnect can exacerbate market volatility, as retail investors are more vulnerable to fluctuations caused by market trends. Right now, institutional investors are optimistic about the future of cryptocurrencies, forecasting significant growth, while retail sentiment sits at a low point.

As institutional investment continues to increase, it could lead to more stability in the crypto market. Understanding this divide helps you grasp the broader implications for market dynamics, prices, and potential opportunities. By recognizing the characteristics and strategies of both retail and institutional investors, you can make more informed decisions as you navigate this tumultuous landscape.

The contrast between retail and pro investors is stark, but it's essential for your investment strategy moving forward.