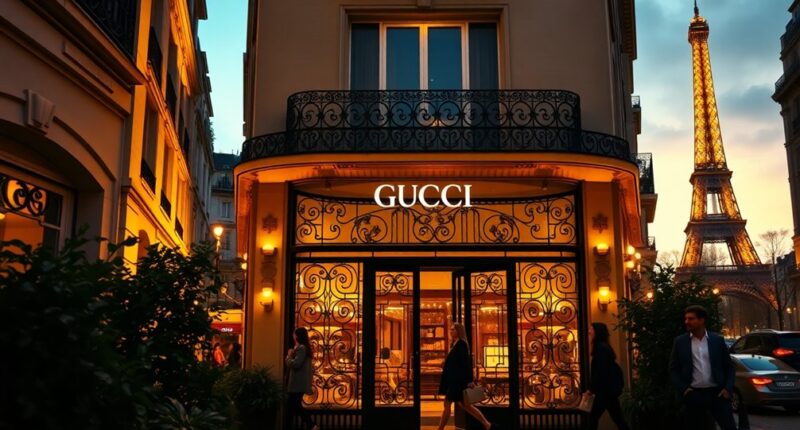

You might wonder what Gucci's recent decision to sell its prime Paris properties means for the luxury fashion landscape. This strategic move seems to signal a shift in their approach to attracting high-end shoppers. By reallocating resources, Gucci could enhance its retail experience and expand its offerings. But what implications does this have for their brand image and market positioning? The answers may reveal deeper insights into the evolving dynamics of luxury retail.

In a bold move to reshape its financial landscape, Kering has sold a majority stake in its prestigious Paris properties, including the iconic Hôtel de Nocé on Place Vendôme and two prime buildings on Avenue Montaigne, to French private equity firm Ardian for €837 million. This transaction isn't just a financial maneuver; it's part of a larger strategy as Kering navigates the challenges in the luxury retail market, particularly with the recent downturn in Gucci's performance.

You might be wondering what this sale means for Kering. By retaining a 40% stake in the newly formed joint venture with Ardian, Kering ensures it still has a significant presence in these prime locations. The deal, expected to close in the first quarter of 2025, is aimed at not only securing long-term locations but also providing Kering with the financial flexibility it needs. The €837 million gained from this sale can be redirected to bolster other business ventures or investments, enhancing Kering's overall financial health.

The properties sold are among the most prestigious in Paris, and their management will now fall under a new joint venture, with Ardian holding the majority stake. This partnership opens up new avenues for collaboration and investment opportunities. With Kering's recent 15% decline in third-quarter sales, largely attributed to Gucci's struggles, this strategic sale demonstrates Kering's adaptability to the shifting market landscape. Additionally, Kering's focus on prime locations is evident in this transaction, highlighting their commitment to maintaining strategic real estate assets.

Focusing on core operations is crucial for Kering, and selling these properties allows you to redirect attention and resources to areas that may yield better returns. The luxury market is constantly evolving, and maintaining a flexible approach is essential for any business striving to stay ahead.

The collaboration with Ardian not only positions Kering favorably but also reflects a keen understanding of how to optimize asset portfolios in a challenging environment. This deal highlights the importance of strategic asset management in luxury retail. By divesting from these properties while still holding a stake, Kering can benefit from the revenue generated by the joint venture without the full burden of ownership.

It's a smart way to leverage what Kering already possesses, turning it into a more dynamic asset that can adapt to market demands. As Kering transitions through this change, you'll likely see the effects ripple through its operations. The funds from this sale could fuel new projects or enhance existing brands, paving the way for future growth.

This strategic move not only addresses immediate financial pressures but also positions Kering to explore new growth prospects, ensuring that it remains a key player in the luxury retail industry. Ultimately, this sale is a calculated step towards a more sustainable and profitable future for Kering.