On Trump's first day in office, there was a lot of hope for a crypto executive order and a Bitcoin Reserve, but ultimately, investors were left disappointed by the silence. Bitcoin's price dropped as market buzz faded. Regulatory changes, like easing SAB 121 restrictions, could boost institutional interest, but uncertainty remains. Despite this, some firms still invested heavily in digital assets, signaling confidence. If you want to discover what's next for crypto, keep exploring the latest updates.

Key Takeaways

- Anticipation for a crypto executive order on Trump's first day was met with disappointment, dampening market sentiment and causing Bitcoin's price to fall.

- Regulatory uncertainty persists, with the SEC's SAB 121 limiting financial institutions' ability to hold cryptocurrencies, affecting broader adoption.

- Analysts express optimism for future regulatory changes, including potential repeals of restrictive measures and pro-crypto policies.

- The concept of a Strategic Bitcoin Reserve remains unclear, with crypto enthusiasts eager for official announcements from the administration.

- Despite political ambiguity, institutional investments in digital assets indicate confidence in Bitcoin's long-term potential and market resilience.

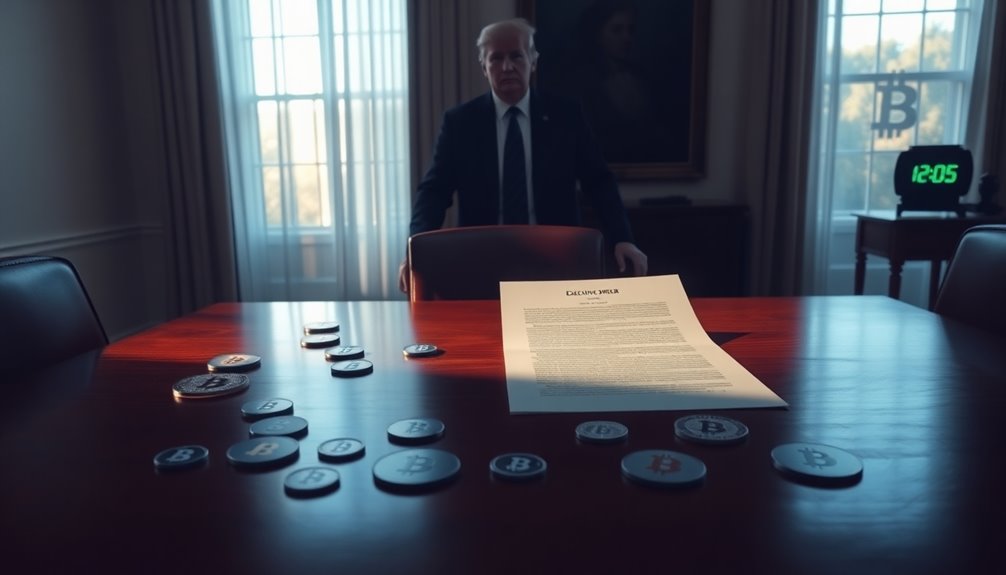

On Trump's first day in office, many were eager to see a crypto executive order, but instead, they faced disappointment as no immediate actions were taken. The anticipation had built up, with the crypto market buzzing over potential regulatory changes. However, without any executive orders issued, Bitcoin's price took a hit, plummeting from $110,000 to $100,000. This sharp decline shocked many, especially those who'd speculated on a favorable policy shift that could strengthen the cryptocurrency landscape.

As you navigate the current crypto landscape, it's important to consider the implications of not repealing the SEC's Staff Accounting Bulletin (SAB 121). This regulation restricts financial institutions from holding cryptocurrencies on their balance sheets, which has stifled broader adoption in the banking sector. Industry leaders, like Circle CEO Jeremy Allaire, predicted that Trump might soon sign an executive order aimed at easing these restrictions, allowing banks to hold digital assets more freely. Such a move could significantly alter the crypto market dynamics, enhancing institutional participation and fostering a more stable investment environment. Additionally, the lack of immediate action on crypto has dampened market sentiment, leading to a cautious approach from investors.

Despite the initial silence on Day 1, many industry analysts remain optimistic. Will Clemente III and others believe that pro-crypto regulations are still on the horizon, despite the rocky start. Speculation about potential future moves, including the repeal of SAB 121 and even possible pardons linked to crypto figures, continues to circulate among market observers. The uncertainty may create volatility in the short term, but seasoned investors understand that this initial negativity doesn't necessarily forecast long-term policy direction.

The concept of a Strategic Bitcoin Reserve also loomed large during Trump's campaign. While he mentioned it at the Bitcoin 2024 conference, there were no official announcements on his first day in office, leaving crypto enthusiasts yearning for clarity.

Interestingly, firms like World Liberty Finance made substantial digital asset purchases, including $47 million each in ETH and wrapped Bitcoin (WBTC), signaling confidence in Bitcoin's future despite the political ambiguity.

As you consider the future of crypto under Trump's administration, keep an eye on the potential for the Strategic Bitcoin Reserve. Felix Jauvin suggested that it could be built up discreetly via the Exchange Stabilization Fund of the Treasury. If executed wisely, this initiative could provide a considerable boost to the crypto market, positioning Bitcoin as a strategic asset for the U.S. government.

Frequently Asked Questions

How Will Trump's Order Impact Existing Cryptocurrency Regulations?

Trump's order could significantly reshape existing cryptocurrency regulations.

You'll likely see a heightened focus on crypto as a national priority, with agencies like the Treasury and Justice Department reassessing their policies.

A proposed advisory council may foster collaboration and transparency.

However, any attempt to pause litigation against crypto companies could face legal hurdles.

What Are the Potential Risks for Investors Post-Executive Order?

Post-executive order, you face several potential risks as an investor.

Market volatility can spike due to sudden price movements or increased speculation. The unpredictable regulatory environment might create confusion, impacting your investment decisions.

Traditional financial institutions could also disrupt services, introducing new systemic risks.

Additionally, overreaching regulations could lead to unintended consequences, making it crucial for you to stay informed and adapt your strategy to the evolving landscape.

Will There Be Any Changes to Tax Implications for Crypto?

You might see changes to tax implications for cryptocurrencies in the near future.

As regulations evolve, you'll need to stay updated on how transactions are reported and taxed.

Capital gains taxes will likely remain, but with potential adjustments in rates or reporting requirements.

If you're trading, consider reassessing your tax planning strategies to align with any new guidelines.

It's crucial to stay informed to avoid unexpected liabilities.

How Might International Relations Be Affected by This Order?

The executive order could reshape international relations significantly.

You might see enhanced cooperation among nations as they align their crypto regulations. This could help establish consistent global standards, impacting trade dynamics and economic security.

The U.S. stance may pressure other countries to adapt, affecting diplomatic ties.

Additionally, the focus on cybersecurity could lead to collaborative efforts in managing cyber threats, ultimately influencing stability in the global landscape and fostering greater international dialogue.

What Role Do Private Companies Play in Implementing the Executive Order?

Private companies play a crucial role in implementing executive orders related to cryptocurrencies.

You'll see them advocating for regulatory changes, like the repeal of burdensome policies. They engage with government councils to shape favorable regulations, ensuring clarity in the crypto landscape.

By investing in digital assets, they navigate market volatility while building strategic reserves.

Additionally, their efforts in research and development help prepare the workforce for industry growth, enhancing consumer protections along the way.