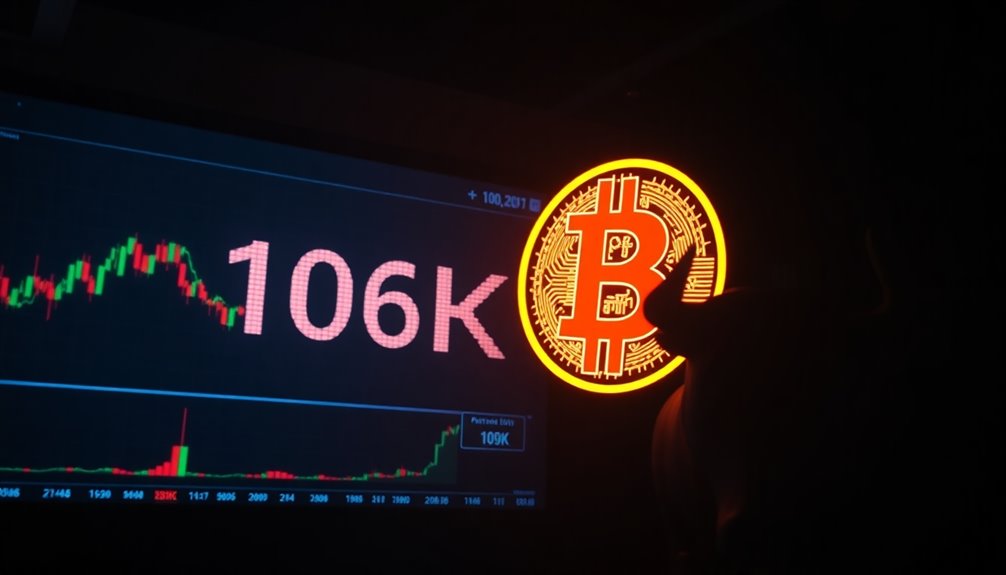

If Bitcoin breaks the crucial $106,000 resistance, it's poised for a rally towards $109,000. The recent bullish momentum, along with strong institutional demand and positive macroeconomic conditions, sets a solid foundation for this potential surge. Analysts highlight technical patterns indicating an upward trajectory, making this a pivotal moment for Bitcoin. As you explore further, you'll uncover more insights into what factors could drive this rally.

As Bitcoin continues to gain traction in the crypto market, you're likely wondering about its rally potential. With its recent bullish momentum and strong recovery, there's a growing sense of optimism among analysts. Many believe Bitcoin could reach impressive price points in the near future, particularly if it breaks the crucial resistance level of $106,000. If this happens, the next target could be around $109,000, paving the way for an exciting upward trajectory.

Analysts have set short-term targets, predicting Bitcoin might hit $122,000 by February 2025. This projection is fueled by robust technical signals and the current market momentum. The Mayer Multiple indicator, which reflects market sentiment, shows a neutral stance, suggesting stability and the potential for further price increases. This combination of factors hints at a rally that could bring Bitcoin closer to its all-time high.

Market dynamics play a significant role in Bitcoin's price movements. Institutional demand has surged, with significant inflows into spot Bitcoin exchange-traded funds (ETFs) totaling around $36 billion. This institutional interest provides a solid foundation for Bitcoin's upward trend.

Furthermore, easing macroeconomic conditions, such as lower inflation concerns and dovish Federal Reserve commentary, contribute positively to Bitcoin's outlook. If these conditions persist, they could facilitate a stronger rally.

However, breaching the $106,000 resistance remains crucial. If Bitcoin can surpass this level, it may gain momentum to challenge the $108,400 mark, which could set the stage for new all-time highs. Historical performance suggests that Bitcoin often follows a four-year dominance pattern, and analysts are optimistic that this cycle might repeat itself, leading to significant price increases.

The technical analysis also supports this bullish outlook. Observing Bitcoin's weekly chart, you'll notice a cup-and-handle pattern that reinforces the idea of an upward trajectory. Additionally, a double-bottom formation indicates that an 11% rally could follow if Bitcoin breaks above the $106,000 mark. A boost in trading volume will be necessary for this to happen, as increased activity typically drives price movements.

While regulatory clarity remains uncertain, it's essential to consider how the current administration's stance could affect Bitcoin's price trajectory. If clear regulations emerge, they could provide further stability and confidence to investors, reinforcing Bitcoin's bullish momentum.